mississippi state income tax calculator

The Mississippi state tax rate is graduated and are the same for individual filers as well as businesses. Check the box - Advanced MSS Income Tax Calculator Confirm Number of Dependants.

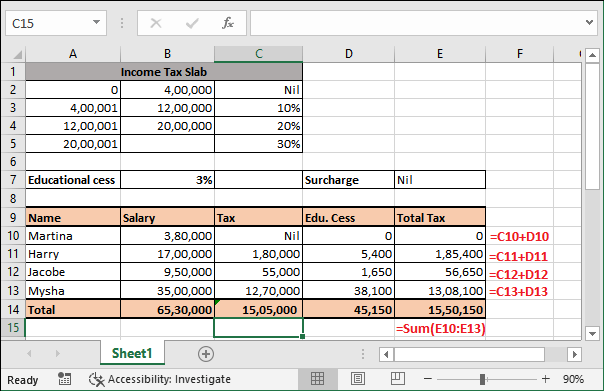

Income Tax Excel Calculator Income Tax Calculation Fy 2020 21 Examples Youtube

His annual taxable income is 23000.

. Get Your Maximum Refund When You E-File With TurboTax. All other income tax returns P. 0 on the first 4000 of taxable income.

Mississippi Income Tax Calculator How To Use This Calculator You can use our free Mississippi income tax calculator to get a good estimate of what your tax liability will be come April. For earnings between 500000 and 1000000 youll pay 4 plus 12000. The graduated income tax rate is.

The Mississippi hourly paycheck calculator will show you the amount of tax that will be withheld from your paycheck. Our Premium Calculator Includes. Switch to Mississippi hourly calculator.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. 1000 X 0 0 4000 X 3 120 5000 X 4 200 13000 X 5 650. To use our Mississippi Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Separation pay and deferred compensation plan distributions do. For earnings between 100000 and 500000 youll pay 3. These rates are the same for individuals and businesses.

Our income tax and paycheck calculator can help you understand your take home pay. Mississippi has a graduated tax rate. Create Your Account Today to Get Started.

The tax brackets are the same for everyone regardless of filing status. On the next page you will be able to add more details like itemized deductions tax. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and Taxes with details on state and local sales income property and automobile taxes - Includes the cost of Child Care for toddlers or infants at a day.

State Date State Mississippi. TurboTax Is Designed To Help You Get Your Taxes Done. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

Only enter the amount received as a normal distribution. Income Tax Calculator 2021 Mississippi Mississippi Income Tax Calculator 2021 If you make 70000 a year living in the region of Mississippi USA. Any income over 10000 would be taxes at the highest rate of 5.

How to use the tax calculator Enter your annual income in Mississippi. 3 on the next 1000 of taxable income. Using the above graduated tax rates lets determine his state tax liability.

The Mississippi tax tables here contain the various elements that are used in the Mississippi Tax Calculators Mississippi Salary Calculators and Mississippi Tax Guides on iCalculator which are designed for quick comparison of salaries and the calculation of withholdings for typical employees and employers. Enter your salary or wages then choose the frequency at which you are paid. Income Tax Brackets All Filers No cities in Mississippi charge local income taxes.

Press Calculate to see your Mississippi tax and take home breakdown including Federal Tax deductions How to use the advanced Mississippi tax calculator Enter your income. You will be taxed 3 on any earnings between 2001 and 5000 4 on the next 5000 up to 10000 and 5 on income over 10000. Ad Free Tax Calculator.

Mississippi allows for a subtraction of retirement income on the state return. 5 on all taxable income over 10000. John is filing as a single taxpayer in Mississippi.

Change state Check Date General Gross Pay. There is no tax schedule for Mississippi income taxes. Ad Free For Simple Tax Returns Only.

The tax rates are as follows. See What Credits and Deductions Apply to You. So if you earn 10 an hour enter 10 into the salary input and select Hourly Optional Select an alternate state the Mississippi Salary Calculator uses Mississippi as default selecting an alternate state will use the tax tables from that state.

As you can see your income in Mississippi is taxed at different rates within the given tax brackets. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Income below 2000 is not taxed at the state level.

If you make 141500 in Mississippi what will your salary after tax be. 0 on the first 2000 of taxable income. Mississippi Resources Mississippi calculators Mississippi tax rates Mississippi withholding forms More payroll resources.

After a few seconds you will be provided with a full breakdown of the tax you are paying. 4 on the next 5000 of taxable income. Tax Rate Income Range Taxes Due 0 0 - 3000 0 within Bracket 3 3001 - 5000 3 within Bracket 4 5001 - 10000 4 within Bracket 5 10001 5 within Bracket.

4 on the next 5000 of taxable income. Mississippi Code at Lexis Publishing Income Tax Laws Title 27 Chapter 7 Mississippi Code Annotated 27-7-1 Income Tax Regulations Title 35 Part III Mississippi Administrative Code. Mississippis SUI rates range from 0 to 54.

The taxable wage base in 2022 is 14000 for each employee. Information on Available Tax Credits. Calculate your Mississippi net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Mississippi paycheck calculator.

The chart below breaks down the Mississippi tax brackets using this model. Enter Your Tax Information. Yes Mississippi residents are subject to state personal income tax.

Mississippi State Unemployment Insurance SUI As an employer youre responsible for paying SUI remember if you pay your state unemployment tax in full and on time you get a 90 tax credit on FUTA. Box 23050 Jackson MS 39225-3050. For earnings over 1000000 youll pay 5 plus 32000.

Early or Excess distributions do not qualify for this subtraction. Married Filing Jointly Tax Brackets. The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5.

3 on the next 3000 of taxable income.

Income Tax Calculating Formula In Excel Javatpoint

Excel Income Tax Calculator For Fy 2021 22 Ay 22 23 And Fy 22 23 Ay 23 24 Only 30 Second

Income Tax Calculator Officebabu Com

Income Tax Calculation Formula With If Statement In Excel

Income Tax Calculator 2021 2022 Estimate Return Refund

Excel Formula Income Tax Bracket Calculation Exceljet

Income Tax Calculating Formula In Excel Javatpoint

Mississippi Tax Rate H R Block

How To Create An Income Tax Calculator In Excel Youtube

How To Calculate Income Tax In Excel

Income Tax Calculation Formula With If Statement In Excel

How To Calculate Income Tax In Excel

Mississippi Income Tax Calculator Smartasset

How To Calculate Income Tax In Excel

Build A Dynamic Income Tax Calculator Part 1 Of 2 Accounting Advisors Inc

Mississippi Income Tax Calculator Smartasset

How To Calculate Income Tax In Excel